Finance that brings a smile to your face

- Borrow £150 - £15,000

- Save whilst you repay

- Terms that actually suit you

- Apply in minutes on our mobile app

Work out the cost of your loan

Borrow from your credit union

For the new member

Example: if you borrow £300 and pay £10 per week. You’ll repay your loan over 34 weeks and pay £37.44 interest – repaying a total of £337.44.

For the child benefit loan

Example: if you borrow £300 and pay £10 per week. You’ll repay your loan over 34 weeks and pay £37.44 interest – repaying a total of £337.44.

For the member with savings

Example: if you borrow £1,200 and pay £20 per week. You’ll repay your loan over 71 weeks and pay £208.29 interest – repaying a total of £1,408.29.

For more than £3,000

Example: if you borrow £6,000 and pay £70 per week. You’ll repay your loan over 97 weeks and pay £774.77 interest – repaying a total of £6,774.77.

For loans fully secured to savings

Example: if you borrow £800 and pay £20 per week. You’ll repay your loan over 42 weeks and pay £29.76 interest – repaying a total of £829.76.

Join over 4,500 people in South Manchester

Here’s how you can open an account with South Manchester Credit Union:

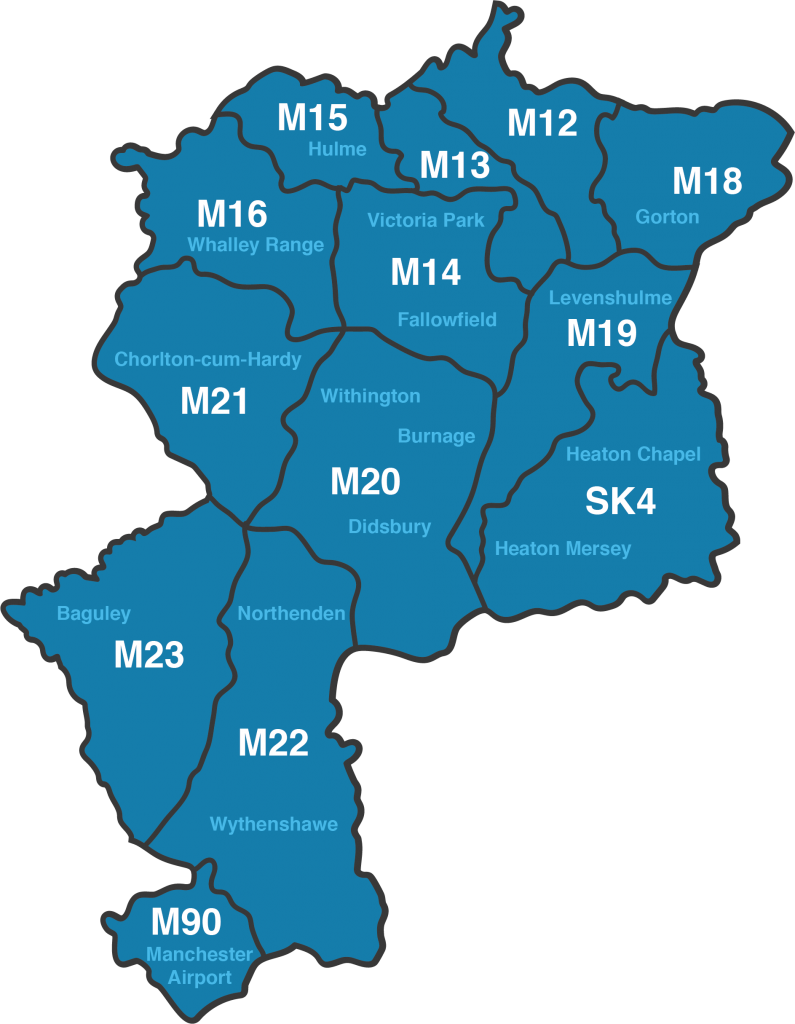

- Spot your postcode on the map

- Download our mobile app Nivo

- Have ID that shows you and your address

Subscribe to our newsletter

Stop scrolling and subscribe for access to our newsletter! We handpick news and promotions to help with your moolah.

Put finance at your fingertips

Nivo is an instant messaging app that gives you full access to your credit union account.

You can join, ask for withdrawals, apply for loans and best of all, keep in contact with your favourite credit union!

Saving with your credit union

Open Savings

Deposit as much or as little as you like and withdraw once a month to make saving a lot easier.

Christmas Club

Lock your savings until 1st November with the savings account dedicated to the festive period.

Win up to £5,000

just by saving

Every £1 you save with the Prize Saver savings account is 1 entry into the monthly draw – you’re allowed up to 200 entries.

The monthly top prize is £5,000 and if you don’t win that, you’re still in with a chance to win one of the £20 prizes.