Borrow up to £700 this Christmas!

This loan is for new members only

Cover the Christmas costs this year

Christmas, without the stress

Don’t worry about the Christmas expenses this year, we’ve got you covered with a Welcome Loan.

You can apply to borrow £150 – £700 and have the money paid into your account usually on the same day.

We will assess your finances and perform a credit check.

The annual interest on our Welcome Loan is 36% (APR 42.6%) on the reducing balance. So as you make your repayments, you’ll pay less interest.

This is an easy way to reduce the stress of Christmas. We can give you a helping hand by spreading out the cost and give you a Christmas to remember. Tis the season to be jolly and nothing will make you jollier than a financial boost!

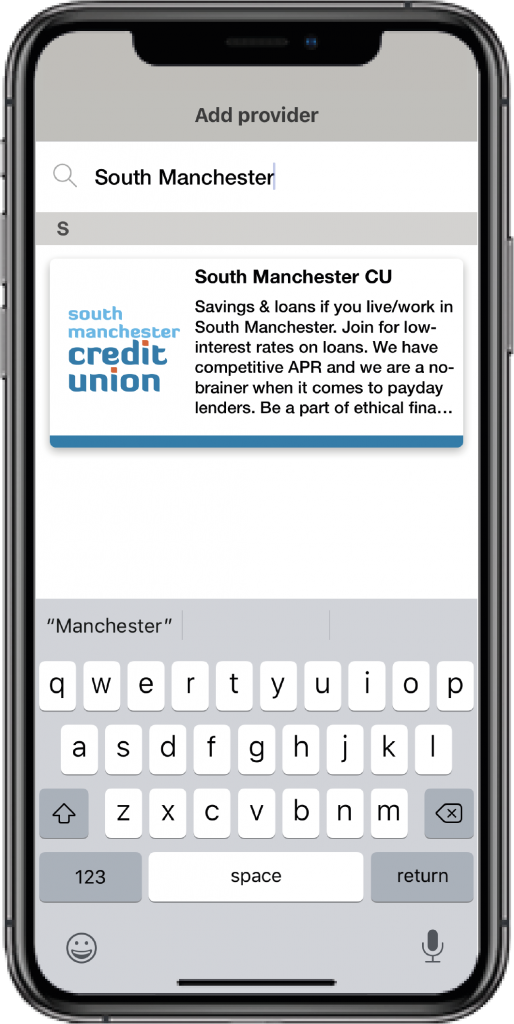

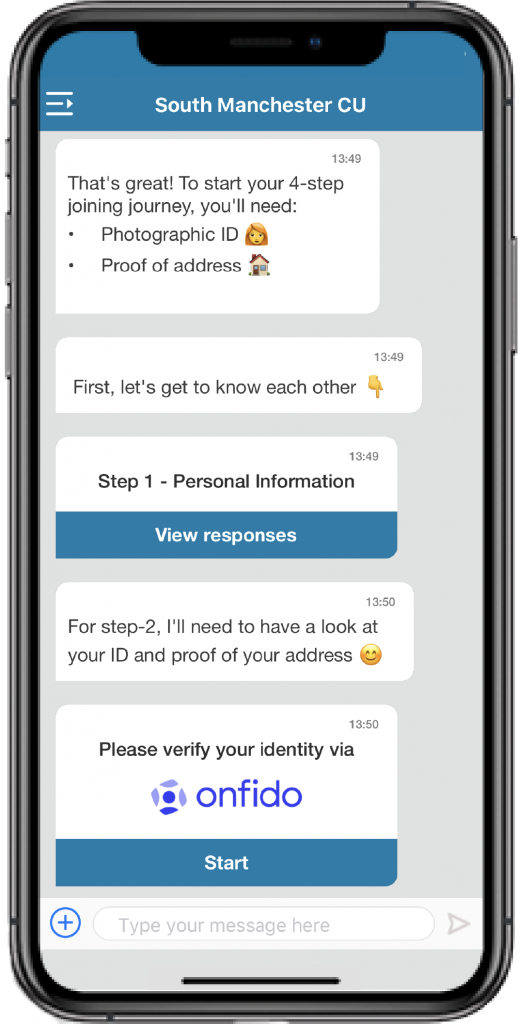

Let's have a look at how simple it is to open an account

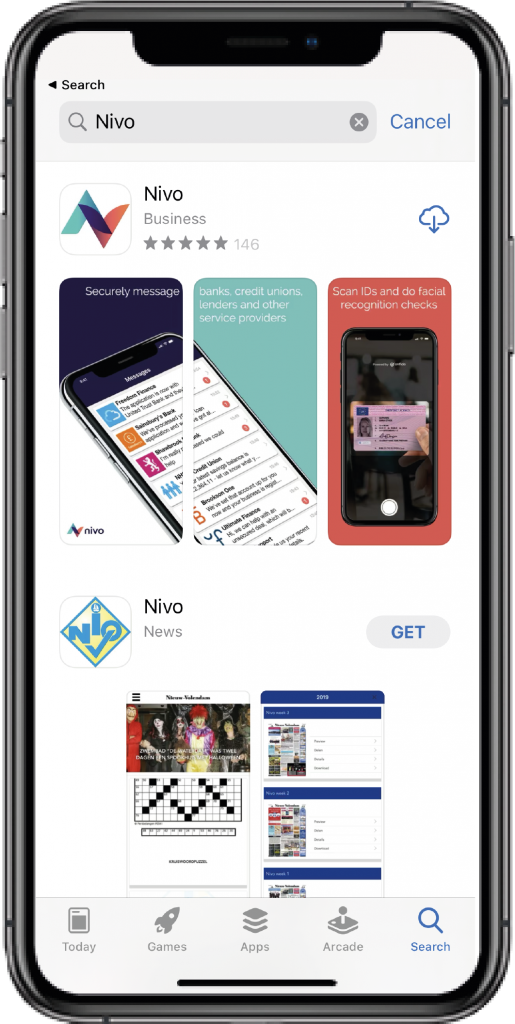

Download the app

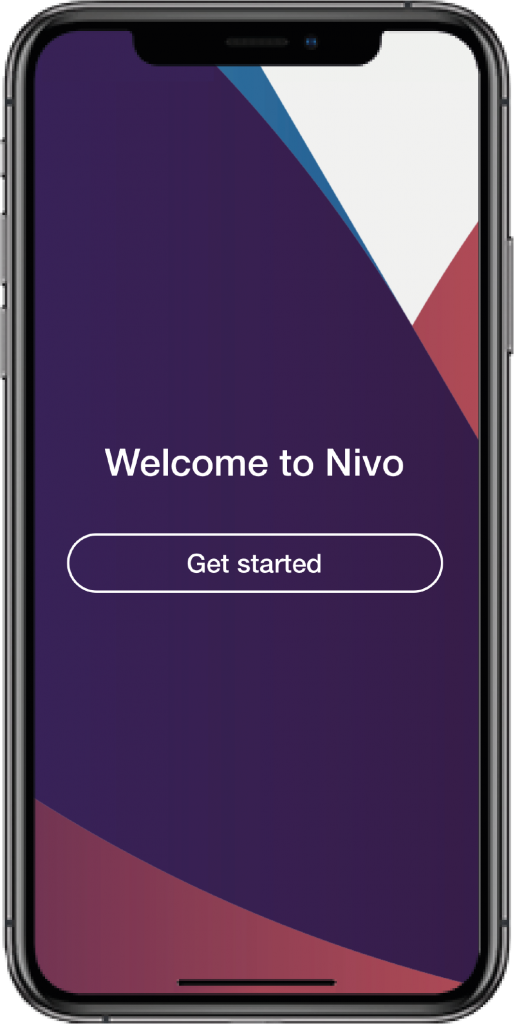

Click get started

Click get started

Create a secure and memorable pin

Search

South Manchester

Credit Union

Search

South Manchester

Credit Union

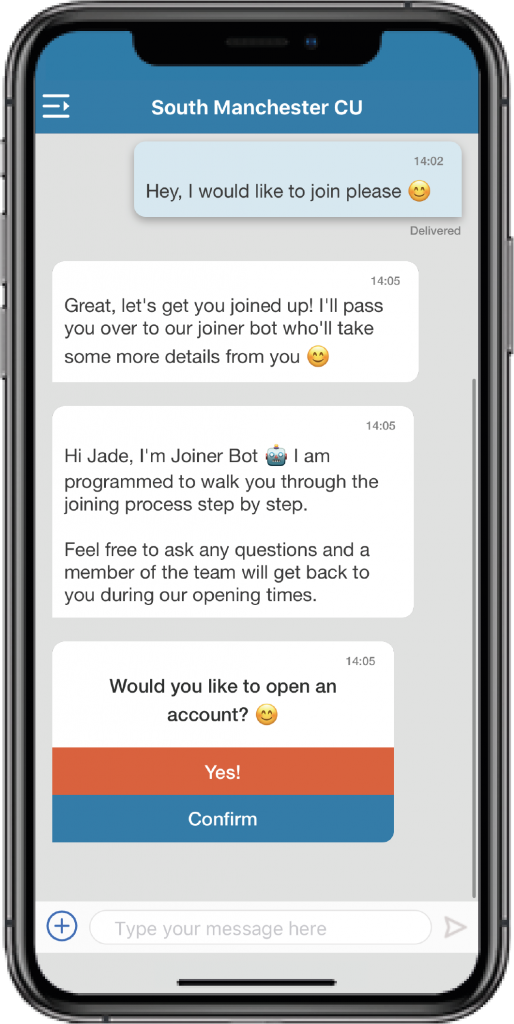

Our Joiner Bot will guide you through the process

Make sure your postcode is on the map

Make sure your postcode is on the map

Get your ID ready to verify your identity

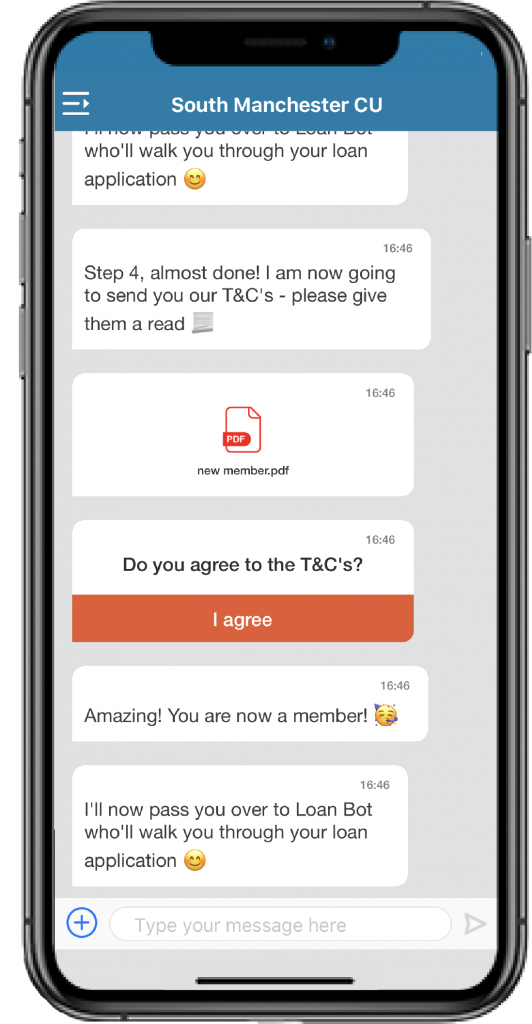

Congratulations, you've opened an account!

Congratulations, you've opened an account!

This is how it works...

Join the credit union

First things first, let’s open your account.

We complete an ID check to verify who you are and where you live.

Apply for your Welcome Loan

Once your account is open, your credit union membership starts.

This means that you can apply for your first loan!

With a Welcome Loan, you can apply for anywhere between £150 and £700.

We’ll make sure the repayments are right for you so you can have financial peace of mind.

Sit back and relax

Your first loan will be completed within 2 working days – usually on the same day.

Whilst you’re relaxing, we’ll assess your income, spending and what you’ve got leftover.

This helps us work towards finding your right level of borrowing. It’s important that we know how much you can repay and save so that you can get the most out of your credit union account.

Repayments are simple

We want to make your loan repayments as easy as possible.

Most of our members decide to repay their loan with a standing order. This gives the flexibility of paying weekly, fortnightly or monthly.

Some of our account holders who have children find it really handy to pay through their child benefit. The child benefit is paid into us for your loan repayments and savings and the rest is paid back to you.

This is the same for all other benefits as well as payroll deduction. If you’re undecided, you can have a chat with us so we can work out what may be best for you.

We're good to go

Once our assessment is complete and if your loan is approved – we’ll send over the terms of the loan that we are offering to you.

If you are happy to accept, then go ahead and sign.

We have an agreement.

Start to build your savings

Whilst you’re repaying your loan, you’ll be adding to your savings.

You will have two savings accounts:

- Open Savings – savings available to withdraw up to once per month

- Locked Savings – savings that are pledged to support your borrowing.

Topping up your loan

After 4 months, you could apply to refinance your loan.

The process is near enough the same except there’s no credit check – instead, we just look at your recent bank transactions, loan repayments as well as your level of savings.

Be rewarded for loyalty

After a year of active membership, you can apply for a Saver Loan.

A Saver Loan rewards your membership with a lower annual interest rate of 24% (APR 26.8%) and is annually reviewed for a bespoke Credit Level.

We give our members value every step of the way.