Hello everyone – Ryan here. Just wanted to quickly introduce myself before we get started on today’s blog about cost of living support. I’m the newest member of the marketing team here at South Manchester Credit Union. I really am enjoying bringing you guys the best content we can.

We are proud to announce our Cost of Living Emergency Plan this week. Manchester Evening News and MSN have already picked up on this story. However, we want to keep shouting loud about it so that more people can benefit from what I am about to show you!

Prices are rising and the pressure is on, so, here at South Manchester Credit Union, we have launched a ‘Cost of Living Emergency Plan’. The plan has five vital steps to take, whatever your income bracket or financial situation, to pull through the current crisis and work towards long term financial security for yourself and your family. We are offering support and tips to the people of South Manchester on how to protect themselves and maximise their income. The cost of living continues to soar, who wouldn’t want to keep their own money?

What our CEO had to say about cost of living support

Sheenagh Young, our CEO, says “We are all experiencing a really tough and unpredictable time with everyday costs, such as heating and food bills, rising beyond our income bracket and, as we head rapidly towards the winter, it is becoming a huge source of stress for a lot of people.

“Credit unions are not-for-profit, ethical financial organisations, and we are here to help people. Which is why we have created this ‘Cost of Living Emergency Plan’. It is there to provide support to those on lower incomes, who have struggled to access credit in the past and may feel stuck in a cycle. It is also for those on a more stable income, who are tightening their belts and want to maintain their financial stability.” Wise words Sheenagh.

South Manchester Credit Union's 'Cost of Living Emergency Plan'

1. Maxmise your income

You may not be able to earn more, but there may be ways to maximise your income. Could you upskill yourself to open up more earning potential? Start your own business? Are you accessing all the benefits you’re entitled to? Let’s check what you’re entitled to through our special online benefits calculator. Did you know a third of those eligible (36,000 households) in Greater Manchester are not claiming their Pension Credit (source: GMCA)?

2. Simplify your expenses

Take a close look at your expenses. Are your prioritising the right ones? What are your key bills? We can help you work out what you really want to be spending your money on, so you’re not alone.

3. Kick start your savings habit

No matter what your income, saving is a habit that can be created by you, and can become very addictive. Are you encouraging your children to save? We can help you to create a savings plan so you can create some financial stability for your family’s future. Our new Dream Saver will help you hold on to your dreams, even through this current crisis, so can plan ahead for that dream car, wedding, or holiday.

4. Repair your credit file

Did you know that repairing your existing credit will help you access more affordable credit? We can help you prepare for difficult times ahead by refining what you have spent in the past. We can work with you one to one to help overcome any historic problem that may be causing stress or worry. Looking at your current financial situation, we can work with you to create a way forward. To help you save first, and then borrow in an affordable and structured way.

5. Take good care of your mental health

It’s very easy to feel out of control and overwhelmed. It’s really important to understand you can overcome these challenges with a little help; take care of your financial anxiety. Our Wellbeing Hub on our website offers advice and support to help guide you through difficult times and help you stay in control. Our Cost of Living Support page offers details on other organisations and initiatives that could help.

We like our members to have their say

Here we have almost 800 5-star Google reviews of what our members appreciate about our service. We also wanted to get our members’ views on how they feel we have helped them through the crisis so far, so that’s exactly what we did. Here is what four of them have to say about us:

Lisa, a single parent living on benefits, says we are helping her to budget and restore her credit through the cost of living crisis; “The credit union has supported me through some very tough times and is now helping me to start saving for the first time. They have been my guardian angels through this cost of living crisis.”

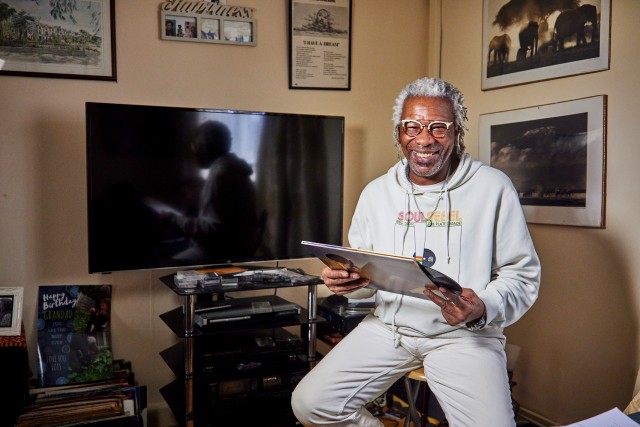

Winston, a retired DJ and stagehand in the music industry, says we are good for his mental health; “I always feel secure knowing my money is being looked after by the credit union as they only ever do what’s best for me. They have given me complete financial peace of mind.”

Hichem is working as a cargo agent. He said we have helped him to focus on simplifying his expenses and repair his credit. “The credit union’s consolidation loan meant I was able combine all of my loan repayments from other providers into one simple loan package. Their helpfulness, professionalism, and positivity have made navigating this cost-of-living crisis much more straightforward.”

Kimberley, a working single parent and student, said; “credit union has been a lifeline for me. I’ve been able to get two car loans, as well as save up for rainy days. They help you into a better financial position and equip you with the money management skills you need.”

Thank you to Lisa, Winston, Hichem, and Kimberley for sharing the positive impact your credit union is having on your lives.

So what can we do?

Sheenagh followed on from her earlier comments; “Following two years of the pandemic, our communities are struggling once again. Many who have never experienced debt and hardship are facing a very uncertain winter, and we can help. We are able to lend money to help people with their day to day living costs as well as helping them save for a more secure future.”

More people need us during these times, so get involved, shout loud with us, and open your own credit union account today so we can continue to provide cost of living support.

Want to know more? Have a chat to us on our Nivo app, subscribe to our two monthly emails, or have a look around our website.